Wonderful Tips About How To Read Trend Lines In Forex Broken Line Organizational Chart

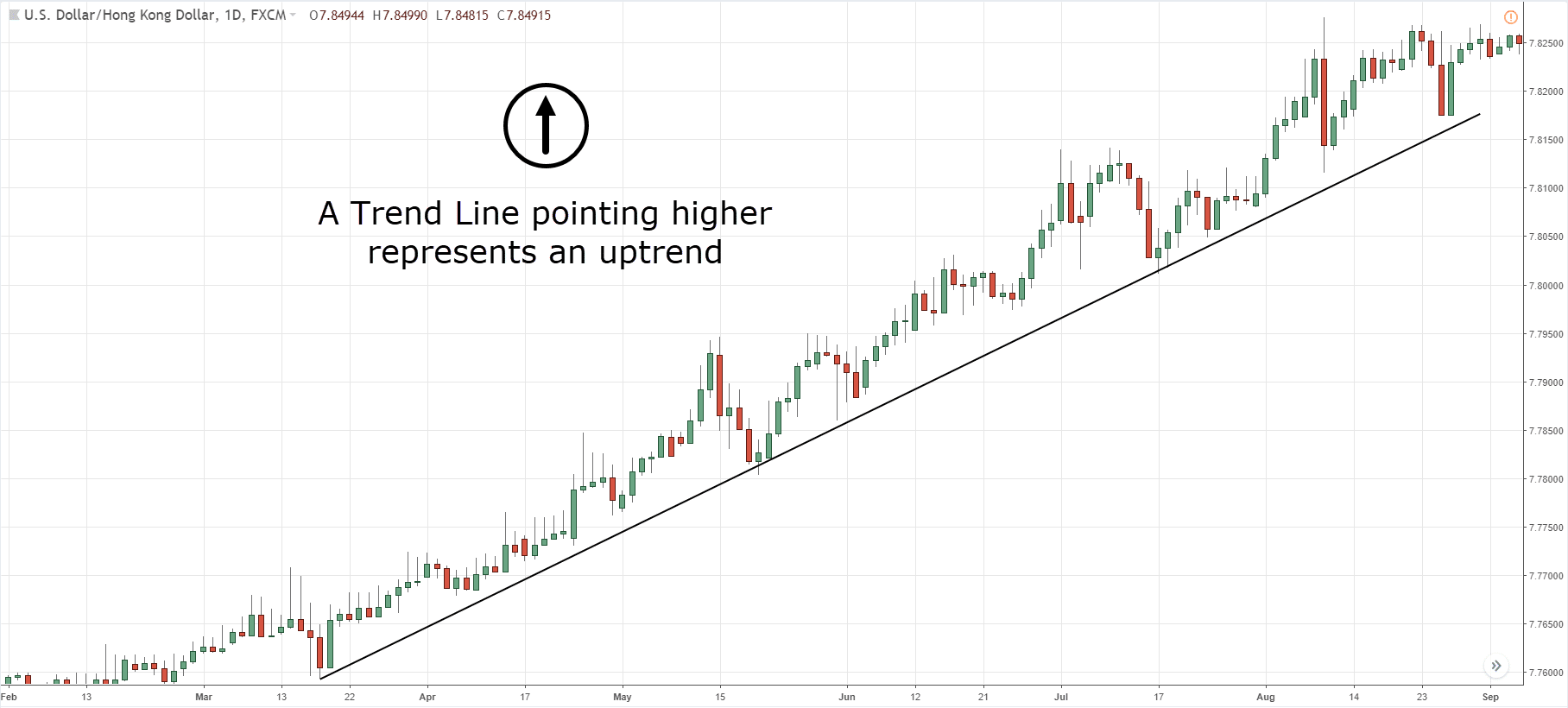

Trendlines measure the price move of a forex pair when the price is increasing or decreasing.

How to read trend lines in forex. There are three main types of trend lines in forex trading: It represents the direction and slope of a trend and helps traders visualize the market’s overall movement. We’ve already covered the strategy of trend trading in the strategies and risk course.

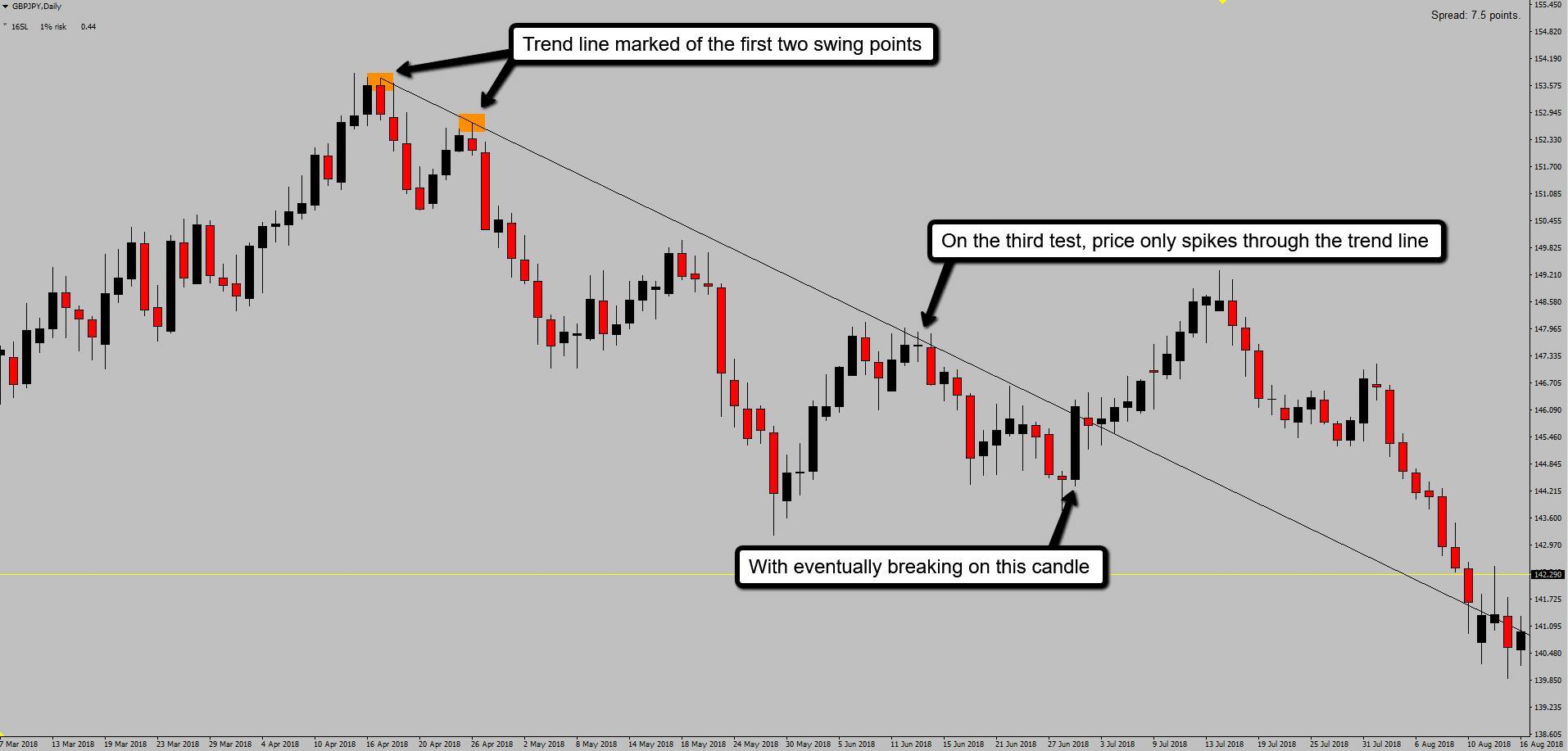

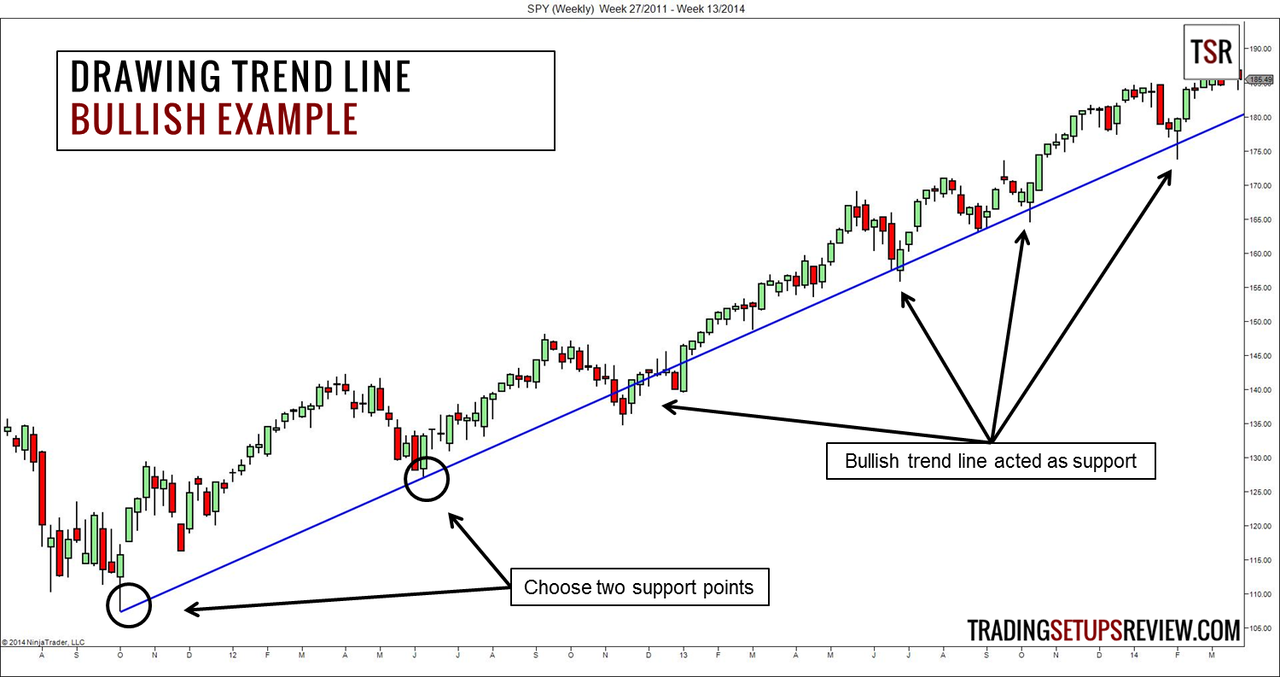

This guide will walk you through everything you need to know about trendline trading, from the basics of drawing trendlines to using them to. When drawing trend lines it is best if you can connect at least two tops or bottoms together. By drawing trend lines on a forex chart, traders can identify support and resistance levels, confirm price action, and trade breakouts.

Trend lines are essential for accurately identifying market trends in forex trading. A trend is the term for when a given market is moving in one direction overall. Trendline analysis in forex is a crucial price action method that helps us first and foremost in trend detection.

It provides support and resistance levels for successfully placing market entry or exit orders. Trend channels with a negative slope (down) are considered bearish and those with a positive slope (up) are considered bullish. Mining is conducted by miners using hardware and software to generate a cryptographic number that is equal to or less than a number set by the bitcoin network's difficulty algorithm.

Trend lines help to smooth out the oscillations within a market’s price action, enabling you to plot the rough course of any movement. Connecting swing highs and swing lows creates trend lines that act as dynamic support and resistance levels. You apply them to charts, using them to identify the strength and direction of trends.

Price is not always perfect. To draw a trend line, you simply look at a chart and draw a line that goes with the current trend. Afternoon news (27 june 2024)

There are two types of trend lines: There are three main types of trend lines: Trend lines are one of the simplest methods of determining bull and bear runs.

Trend lines are lines drawn on a forex chart to connect consecutive highs or lows in price. A trend line is a straight line that connects two or more price points on a chart. The steeper the trend line you draw, the less reliable it is going to be and the more likely it will break.

Upwards (a bull run), downwards (a bear run) and sideways (rangebound). You apply them to charts, using them to identify the strength and direction of trends. What are trendlines really used for in forex trading?

The first way to spot a possible breakout is to draw trend lines on a chart. Before we learn how to identify the trend, we should first be clear what we are looking for. Uptrend lines, downtrend lines, and sideways trend lines.