Out Of This World Tips About What Is Arima And Garch R Ggplot Line Width

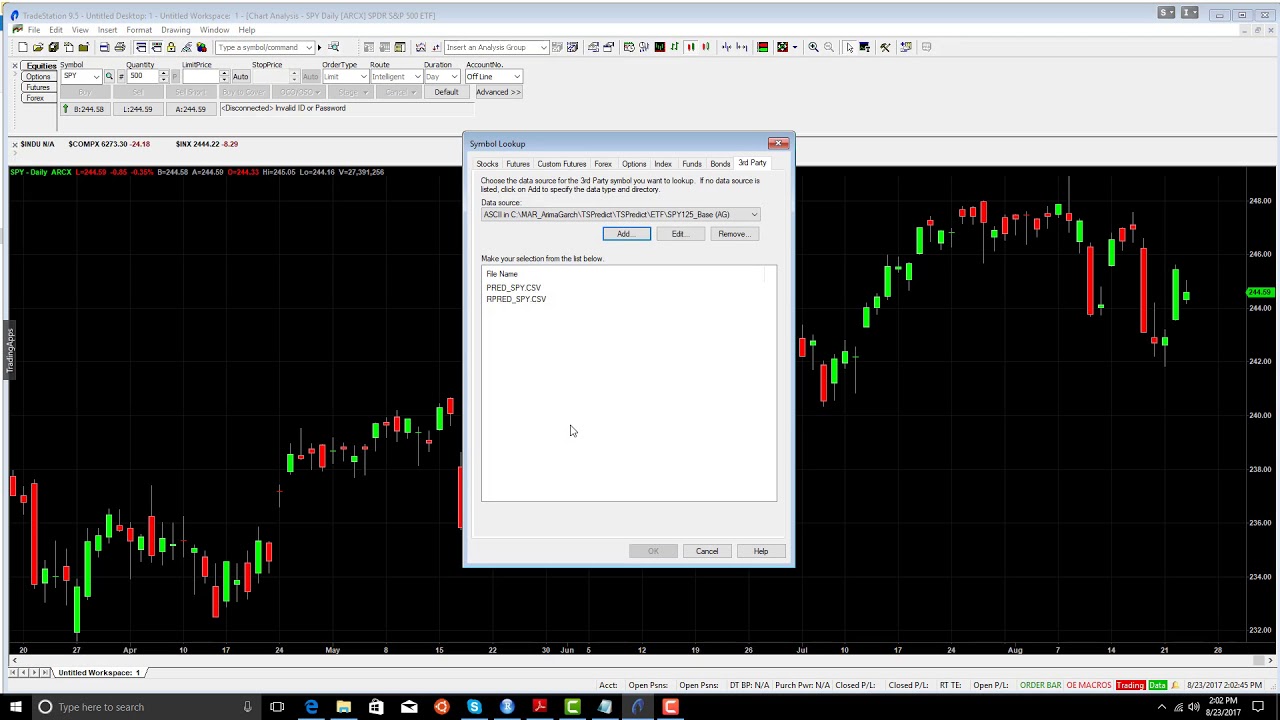

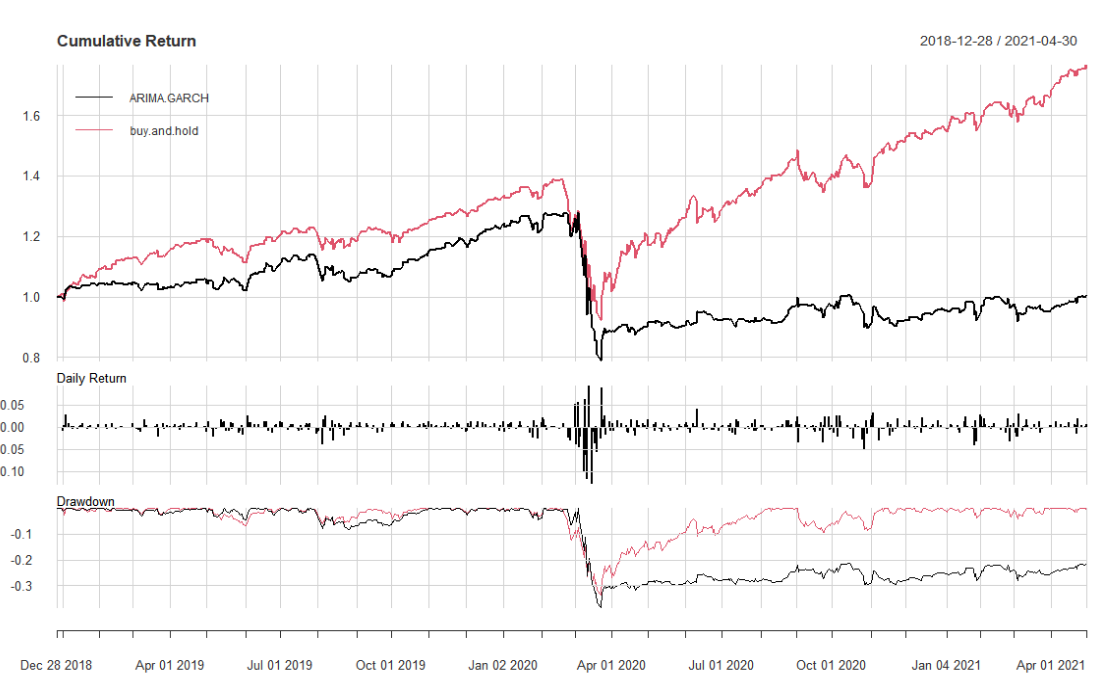

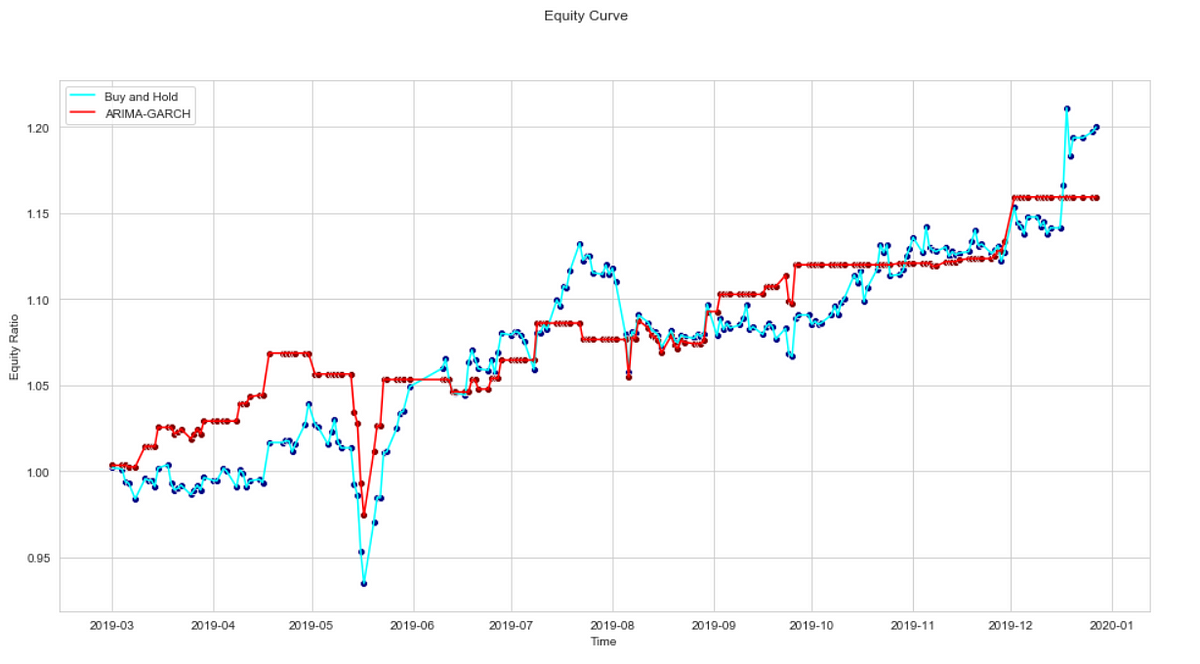

For each day, n, the previous k days of the differenced logarithmic returns of a stock market index are used as a window for fitting an optimal arima and garch model.

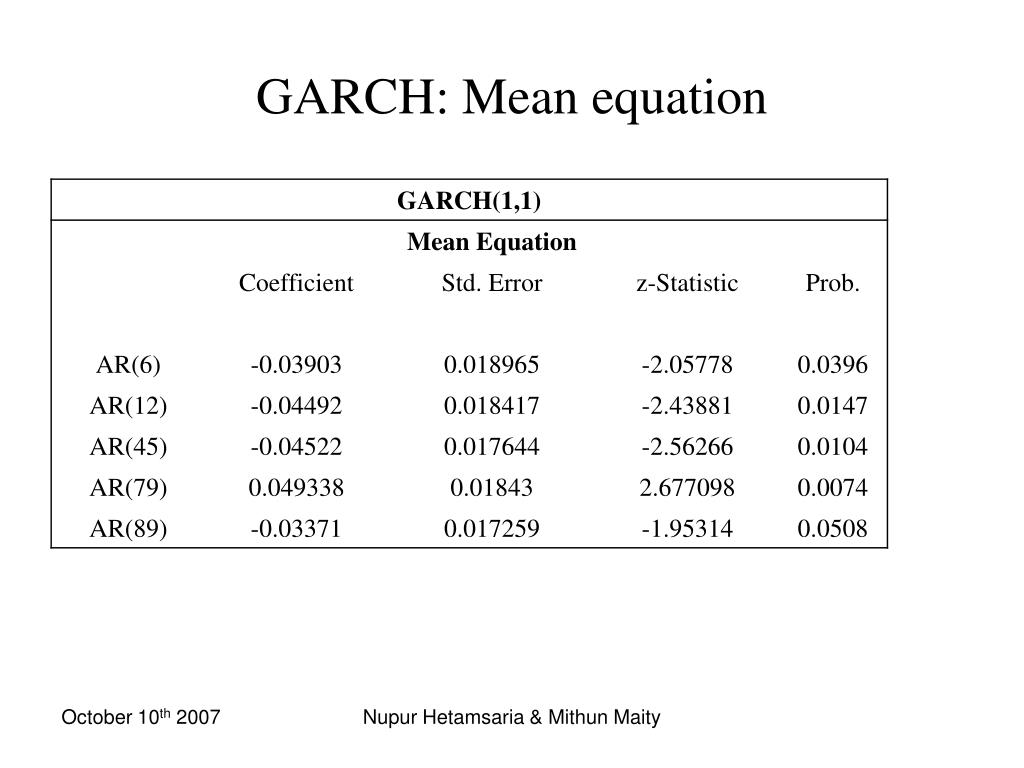

What is arima and garch. Arima is used to model the autocorrelation in time series data, while garch is used to model the volatility clustering in time series data. Asked 4 years, 2 months ago. Part of r language collective.

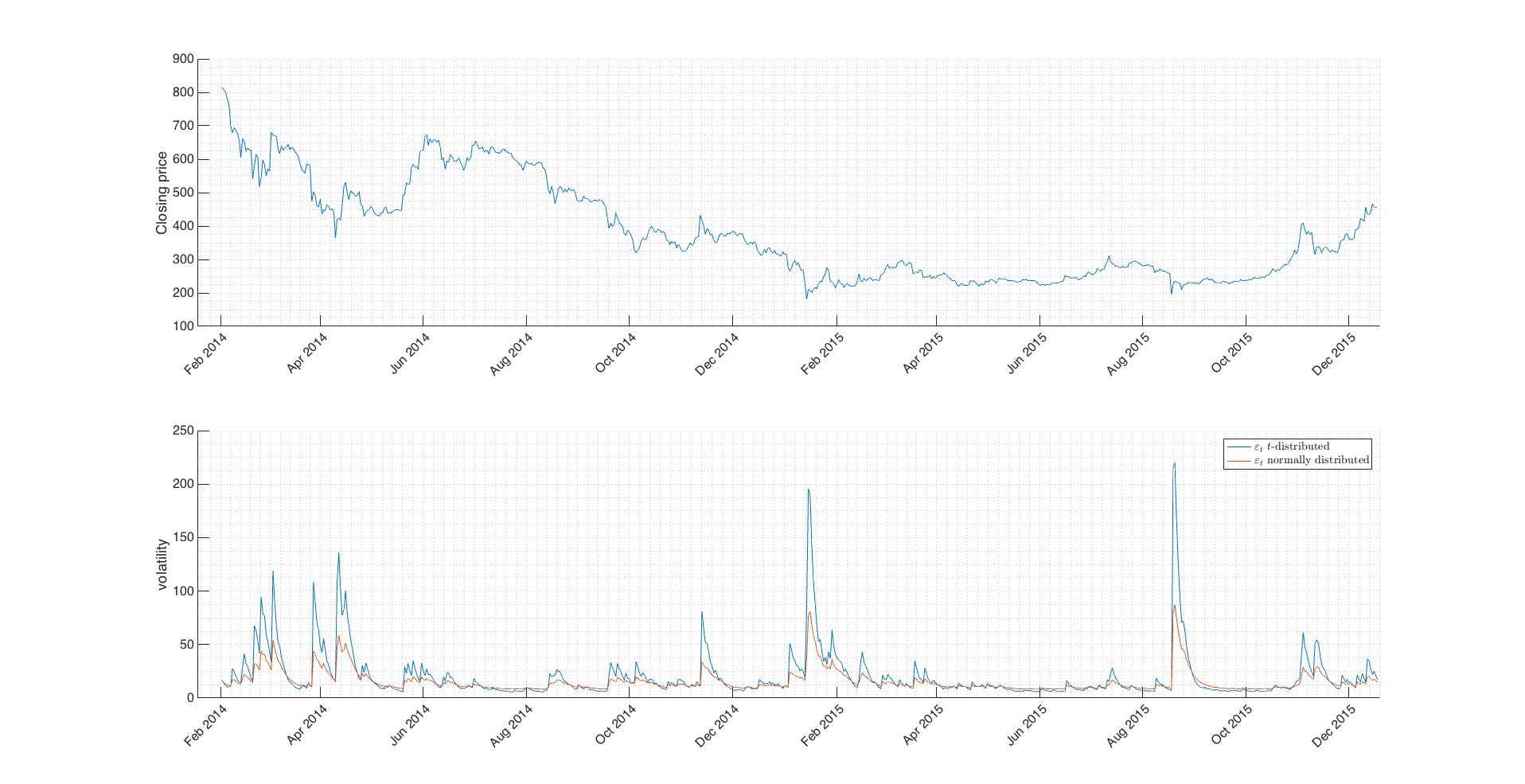

What is arima? Autoregressive conditional heteroskedasticity, or arch, is a method that explicitly models the change in variance over time in a time series. Garch has also proven efficient for financial time series, since it can extract more complex patterns from a time series compared to arma and arima models.

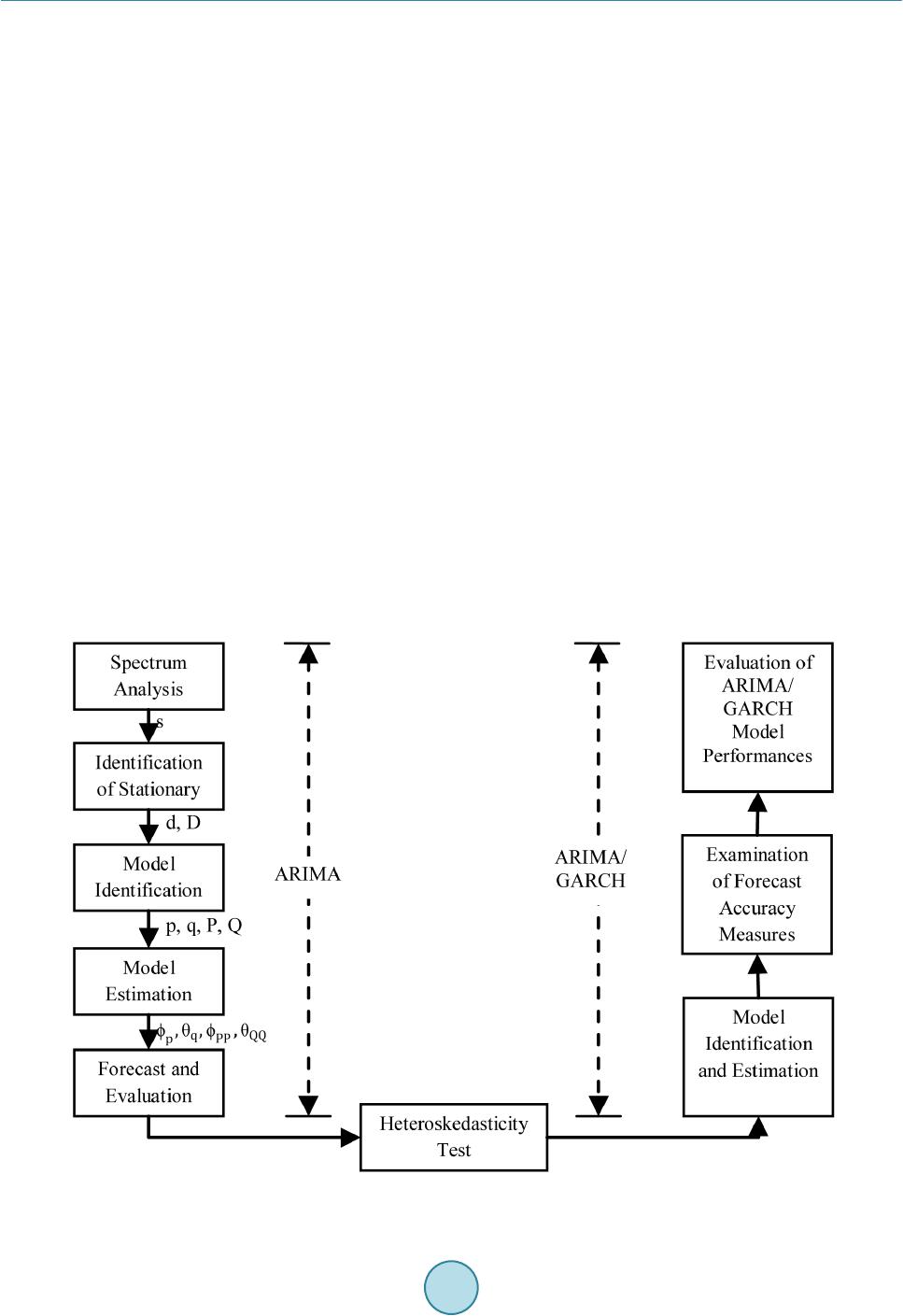

Time series analysis. Forecast using a chosen model which is arima (auto regressive integral moving average) model in our case. Make use of a completely functional arima+garch python implementation and test it over different markets using a simple framework for visualization and.

I am looking out for example which explain step by step explanation for fitting this model in r. Modified 3 years, 6 months ago. Arima is a simple stochastic time series model that we can use to train and.

In this article we are going to consider the famous generalised autoregressive conditional heteroskedasticity model of order p,q, also known as garch (p,q). Arima stands for auto regressive integrated moving average. How does a hybrid model work.

Garch is appropriate for time series data where the. Introduction to time series model. How to use arima in garch model.

Autoregressive integrated moving average (arima) models are used to model and forecast a time series process. I am currently working on arma+garch model using r. Auto regressive integrated moving average (arima) models and a similar concept known as auto regressive conditional heteroskedasticity (arch) models will.