Real Info About What Is The Purpose Of A Trendline Line Break Char

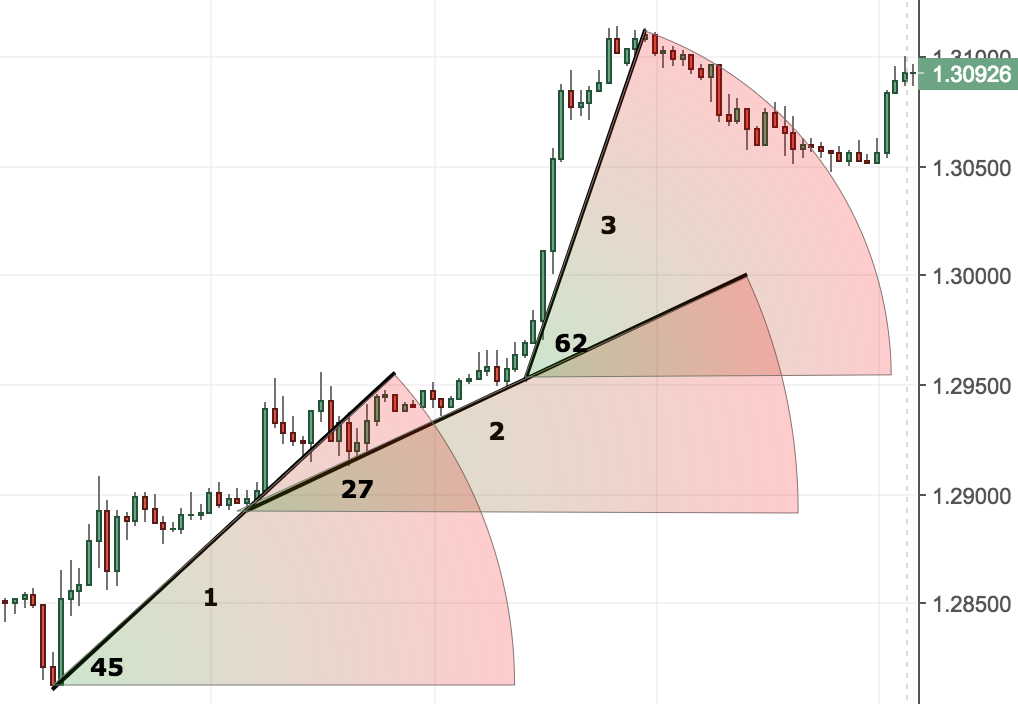

These lines follow a financial asset’s price movement to show traders how high or low the price may move in a particular duration.

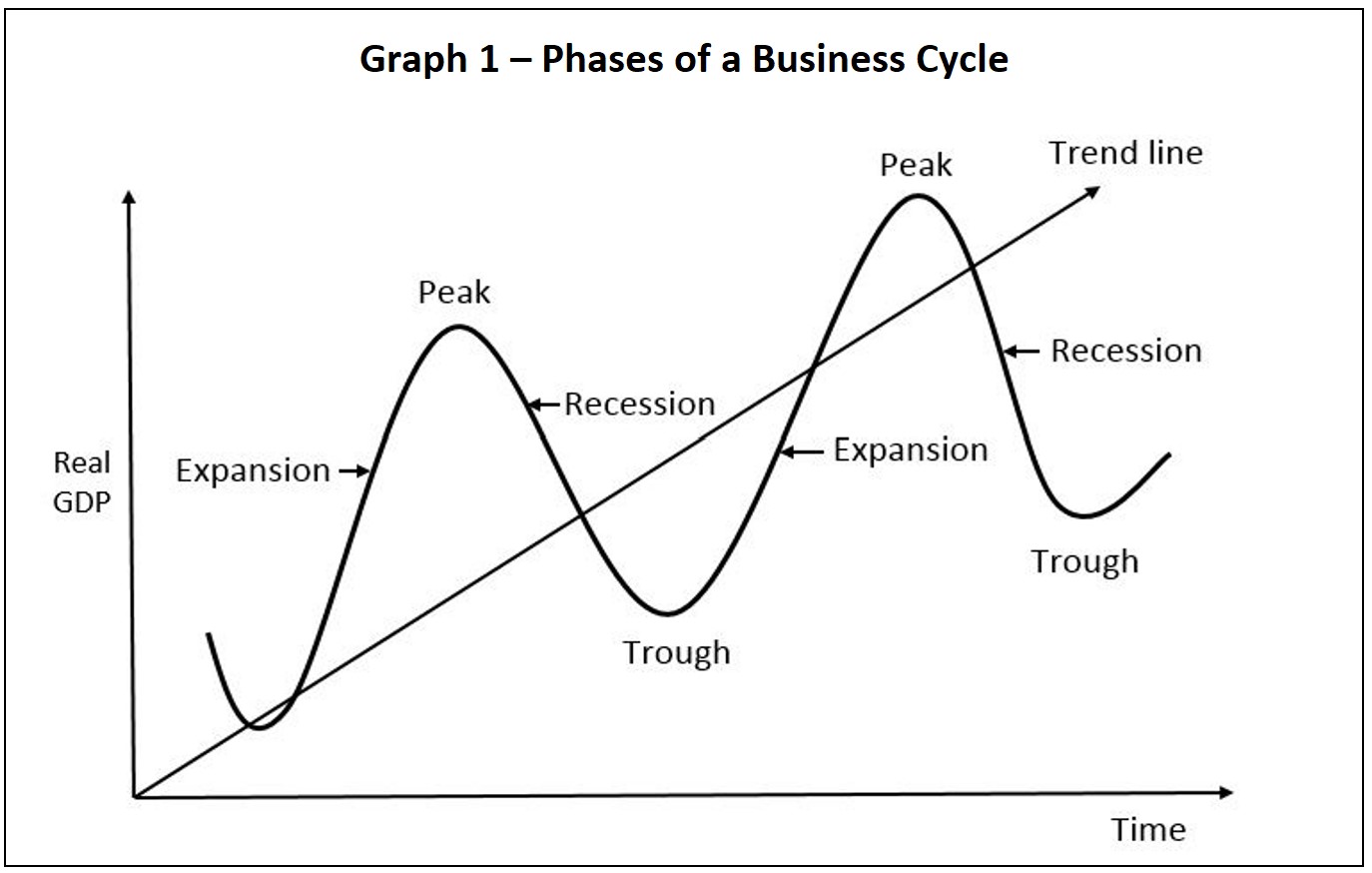

What is the purpose of a trendline. Individuals can utilize the information to buy or sell securities. A trend line is a chart pattern that is defined as a series of highs or lows that form a straight line. A moving average trendline smoothes out fluctuations in data to show a pattern or trend more clearly.

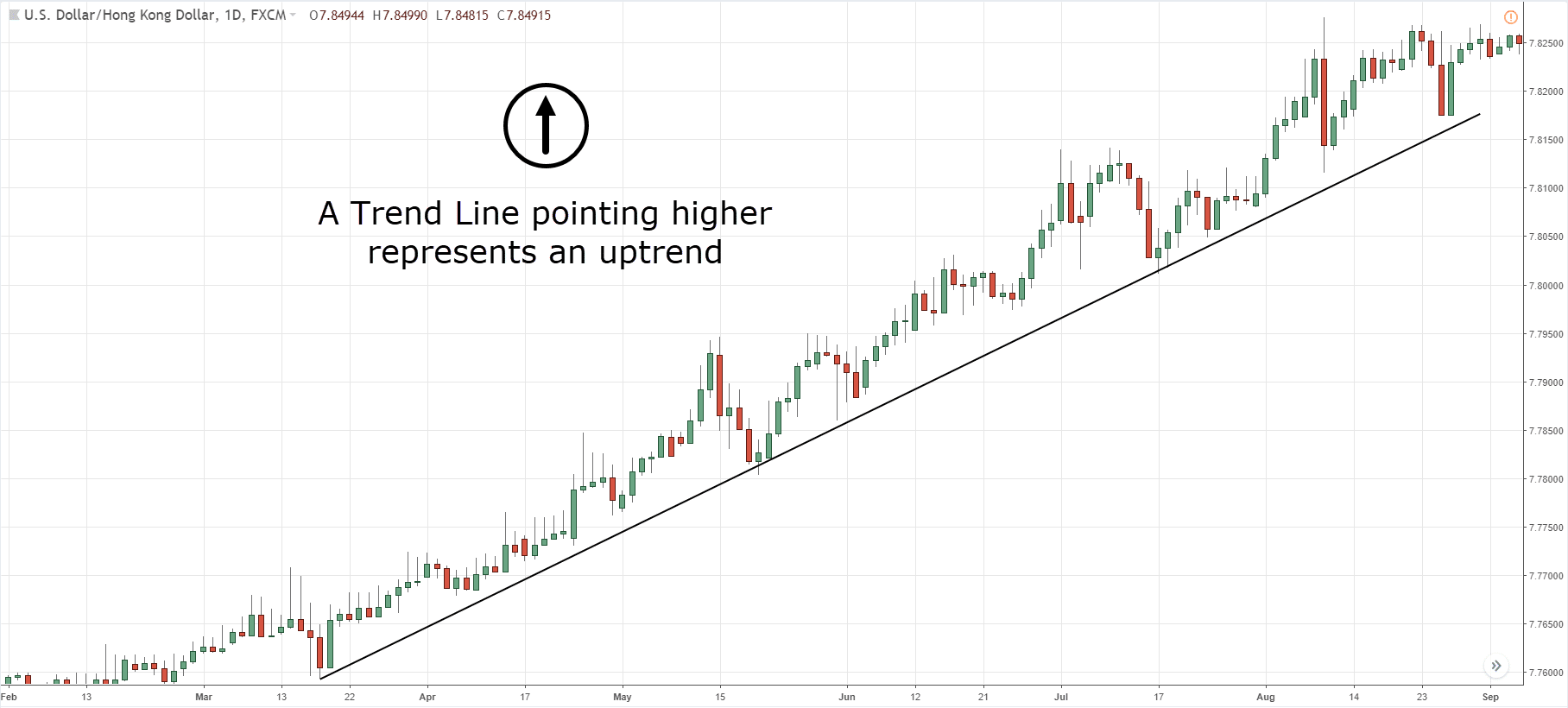

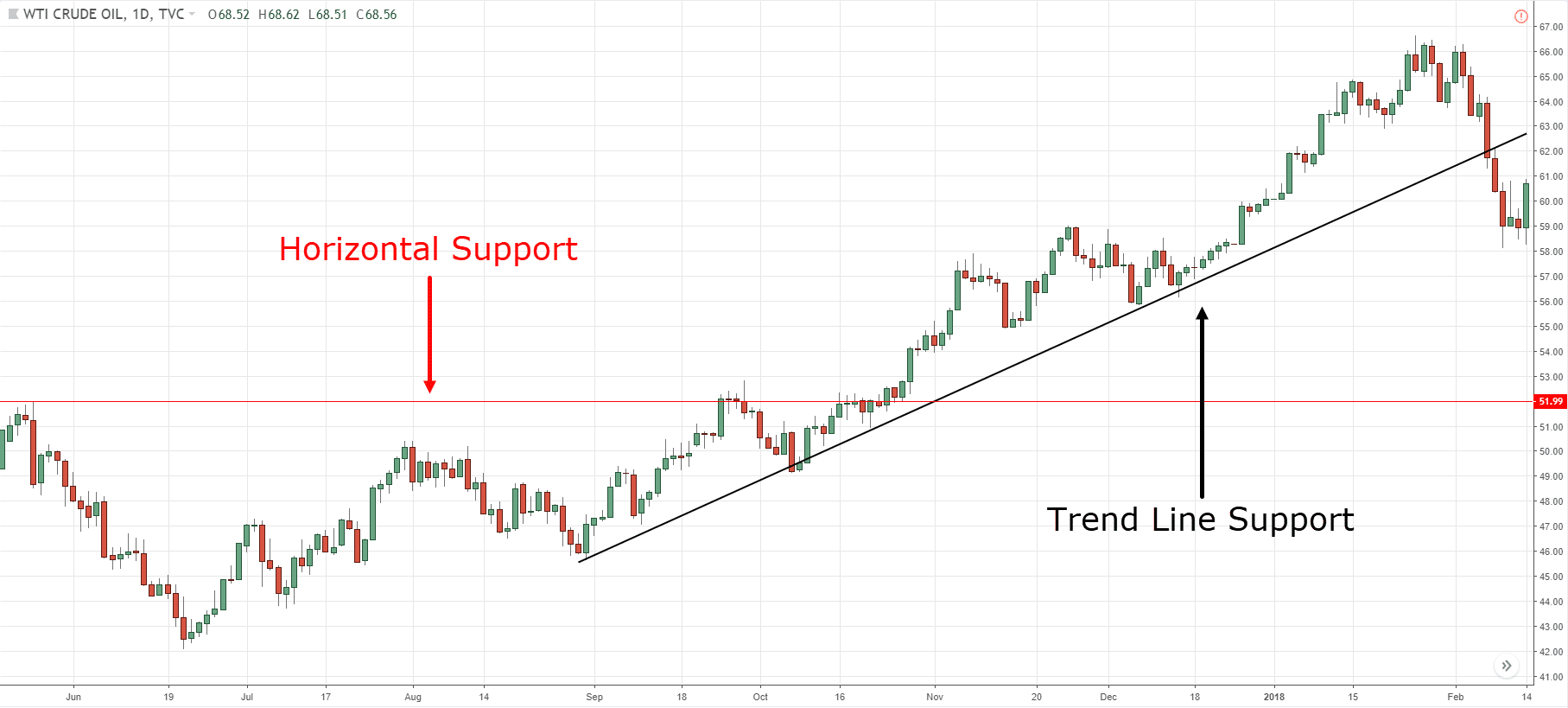

Trendlines are used to visually gauge support and resistance price levels and the trend, whether it is up, flat, or down. In this blog post, we’ll explore trendlines, how to draw them, and what they can tell you about market trends. A trendline is an illustrated line connecting changing key points in a graph, to indicate patterns of directional change.

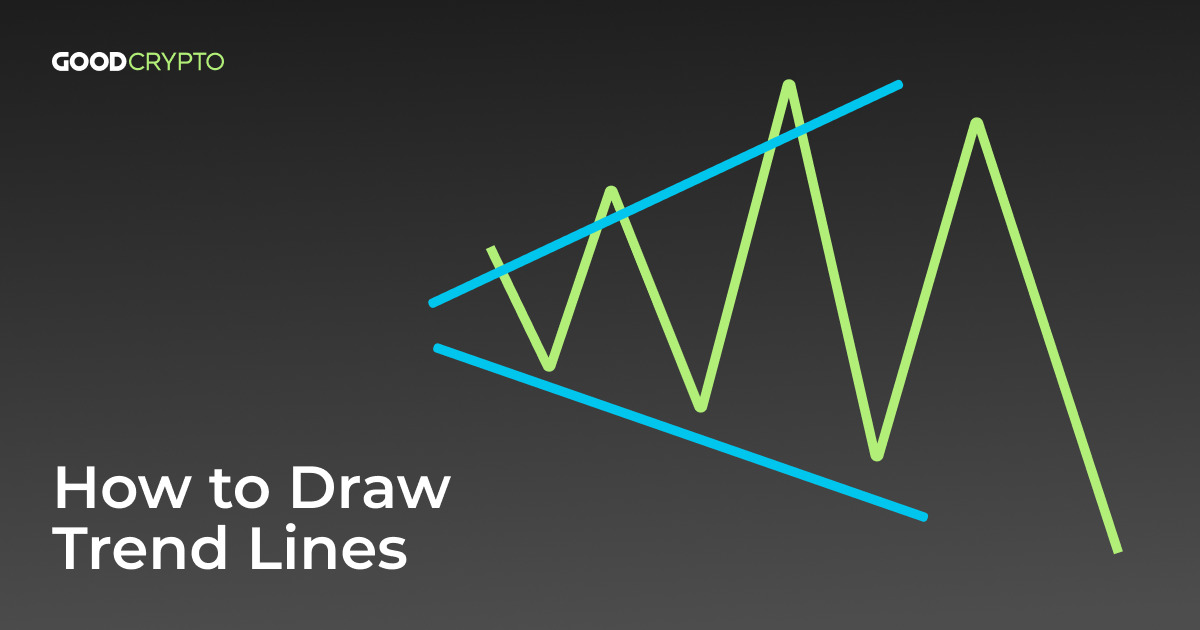

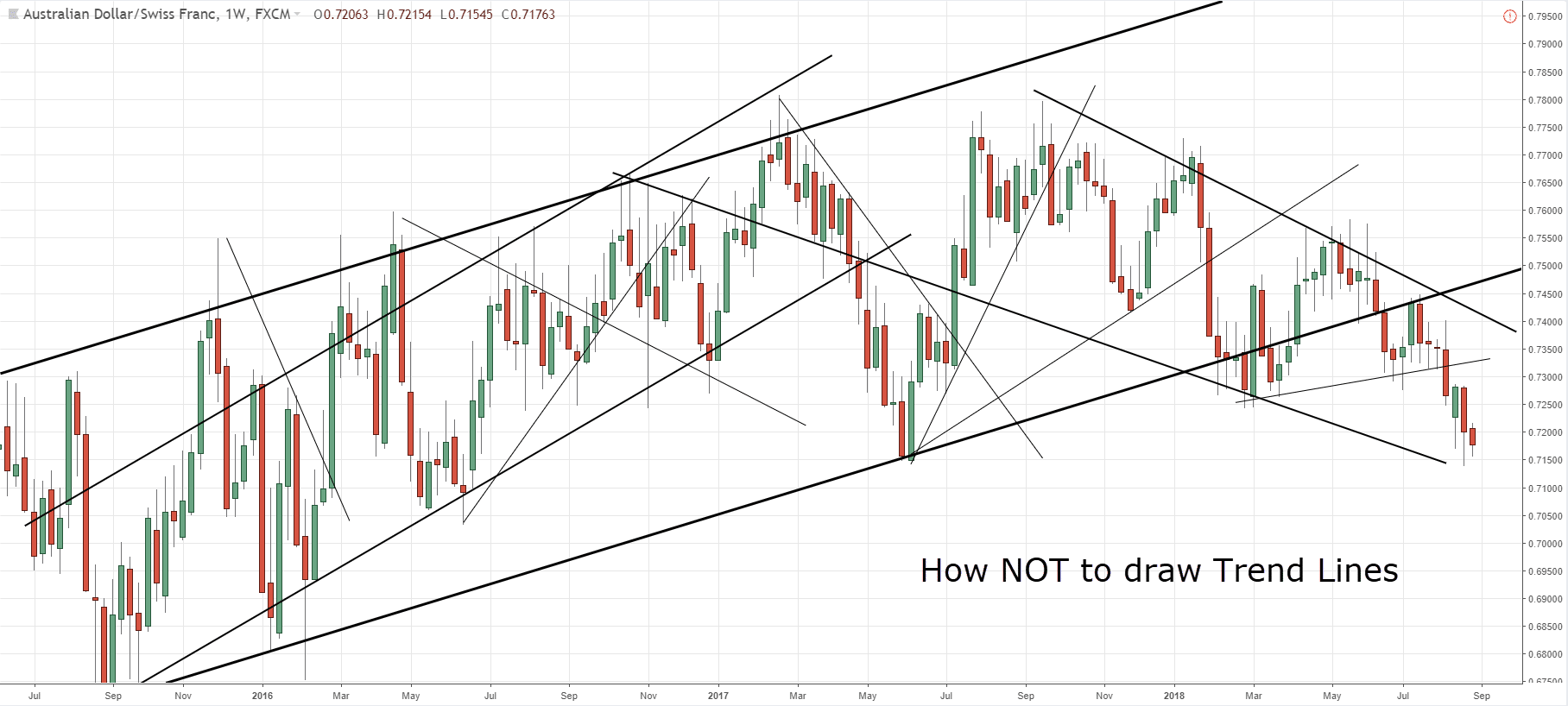

To establish a trend line historical data, typically presented in the format of a chart such as the above price chart, is required. The ability to identify and draw trendlines is one of the most useful tools in technical analysis. This is common practice when using statistical techniques to understand and forecast data (e.g.

Trendlines are custom lines drawn on price charts to connect a sequence of prices to get a likelihood of future trajectory of price. Trendlines are used in sales, financial, stock market analysis and scientific research. So i thought i’d brush up on my statistics knowledge and write about it.

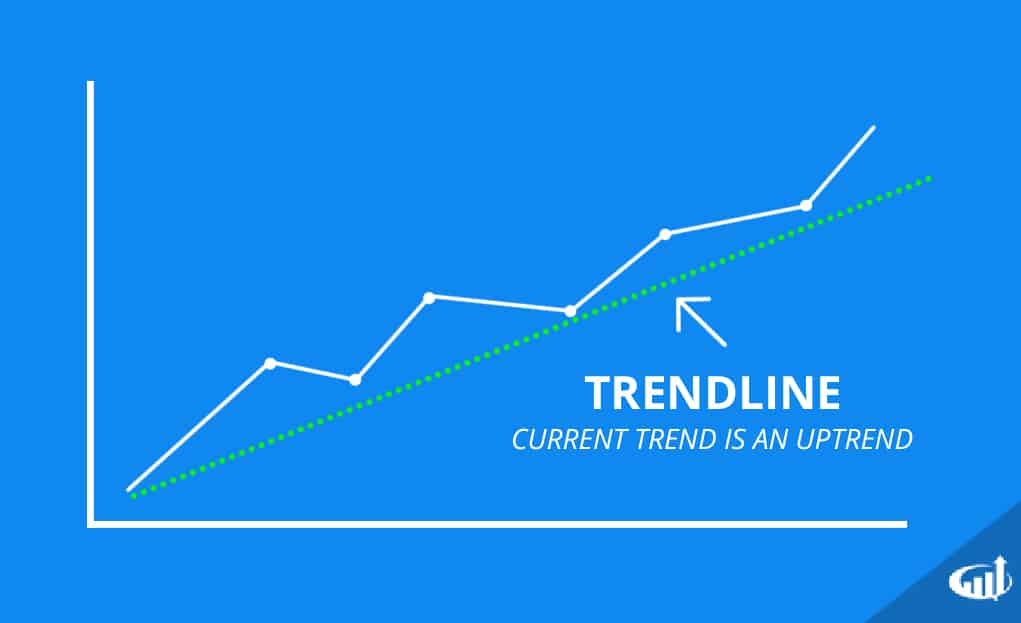

Trendlines are a simple yet powerful technical analysis tool that can help you identify patterns in price movements and make informed decisions about when to buy or sell. A trend line on a graph, also called a line of best fit, is a line that portrays the overall trend of the points on the graph. They also provide insights into whether an asset is a buy or sell at a specific price, and whether a trader should choose to.

A trend line connects at least 2 price points on a chart and is usually extended forward to identify sloped areas of support and resistance. A moving average trendline uses a specific number of data points (set by the period option), averages them, and uses the average value as a point in the trendline. Trendlines visually represent support and resistance in any timeframe by showing direction, pattern and price contraction.

What is a trendline? Trendline equation is a formula that finds a line that best fits the data points. Trendlines are used when trading the financial markets to define an uptrend or downtrend of an asset’s price.

A trendline is a straight line that is drawn on a price chart to connect two or more price points, providing a visual representation of the direction and slope of a trend. Lines with a positive slope that support price action show that net. See figure 1 for an example of a linear trendline.

Trendlines are used to determine whether an asset is in a form of uptrend or downtrend. A trendline is a line drawn on a chart highlighting an underlying pattern of individual values. The purpose of a trend line is to identify the historical trend of the price movements and to indicate support and resistance levels.

In technical analysis, trend lines are a fundamental tool that traders and analysts use to identify and anticipate the general pattern of price movement in a market. Any trend can be used (e.g. They are a type of technical analysis, which many traders use to monitor price movements of a financial instrument in order to predict market sentiment.

:max_bytes(150000):strip_icc()/dotdash_final_The_Utility_Of_Trendlines_Dec_2020-01-1af756d4fd634df78d1ea4479d6af76c.jpg)